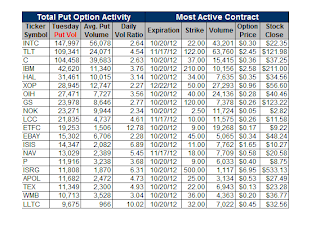

On the options front, trading is active heading into expiration Friday. With two hours left to trade, the projected volume is a respectable 18.5 million contracts. 7.2 million calls and 5.7 million puts traded across the exchanges so far. Nearly 100,000 contracts traded in EBAY on the heels of its earnings report. Trading is active in Green Mountain Coffee Roasters (GMCR), as shares gain 4 percent. The company said today that it will release earnings on November 27. 117,000 options traded on GMCR. Rolling activity is driving a lot of the action as well. Today is the last day to trade many index contracts and tomorrow the last day to trade equity and ETF options. CBOE Volatility Index (.VIX) is ticking a bit higher ahead of expiration Friday, now up .16 to 15.23. Trading is active in the VIX pit. 345,000 calls and 175,000 puts so far.

Notable Flow

RRD – Bearish activity detected in RR Donnelley and Sons Company with 10080 puts trading, or 11x the recent avg daily put volume in the name. Shares near $10.56 (-0.29) with ATMIV lifting by 20.30 point and 85% of todays put premium trading offer side. (Trade-Alert)

ETN – Bearish activity detected in Eaton Corp with 7095 puts trading, or 3x the recent avg daily put volume in the name. Shares near $46.09 (-0.65) with ATMIV lifting by 1.19 point and 50% of todays put premium trading offer side. (Trade-Alert) 13:11

STP – Bullish flow detected in Suntech Power Holdings Co Ltd with 2722 calls trading, or 7x the recent avg daily call volume in the name. Shares near $0.8821 (0.0121) with ATMIV lifting by 26.19 point and 65% of todays call premium trading offer side. (Trade-Alert) 12:41

(Source: Whattrading)